SWIFT, or the Society for Worldwide Interbank Financial Telecommunication, is a global member-owned cooperative that provides secure financial messaging services to more than 11,000 financial institutions in over 200 countries and territories worldwide. It was founded in 1973 with the aim of creating a shared worldwide data processing and communications link and a common language for international financial transactions.

The Society for Worldwide Interbank Financial Telecommunication (SWIFT)

Since its inception, SWIFT has been a significant player in the evolution of the financial industry on a global scale.

Origins and Evolution:

In the 1970s, the international financial sector was expanding rapidly, and the need for a reliable, efficient, and secure system for cross-border payments was evident. In response to this need, SWIFT was established in 1973 in Belgium as a cooperative society under Belgian law. The founding institutions were 239 banks from 15 countries.

Before SWIFT, Telex was the primary method used to send payment messages between banks internationally. However, Telex was neither secure nor efficient. With the advent of SWIFT, the financial industry saw the introduction of a standardized environment for transactions, providing reliability, security, and speed.

Role and Functioning of SWIFT:

SWIFT does not engage in funds transfer; rather, it provides a secure channel for financial institutions to send and receive payment orders. The actual transfer of funds is conducted over correspondent banking relationships, through accounts that financial institutions maintain with each other.

SWIFT provides its members with a standardized system for transactions, making it easier for banks across the globe to communicate. It assigns each financial organization a unique code that has either eight characters or 11 characters. The code is called a Bank Identifier Code (BIC), also known as a SWIFT code.

The SWIFT network is built on the concept of resilience and redundancy, with multiple pathways ensuring that messages are delivered despite temporary failures in parts of the infrastructure. Security and reliability are key features of the SWIFT network, with numerous protocols and controls in place to protect the confidentiality and integrity of the data transmitted.

Products and Services:

SWIFT’s core service is its secure messaging platform. However, it also sells software and services to financial institutions, mostly for use on the SWIFTNet Network. The offerings include products for connectivity, like SWIFT’s VPN and SWIFTNet Link, as well as interface and integration software.

Additionally, SWIFT has been instrumental in standardizing the messaging system in the financial world. For instance, it has developed a set of message types that correspond to various categories of financial transactions. This allows banks to communicate across borders efficiently, reducing misunderstandings and errors.

SWIFT and the Future of Global Finance:

Over time, SWIFT has continued to evolve to meet the needs of its members and to address emerging challenges. A crucial focus area has been the reduction of costs and improvement of efficiency in areas like compliance, payments, securities, and trade finance.

The cooperative has also been proactive in exploring cutting-edge technologies like blockchain. For instance, SWIFT has launched the Global Payments Innovation (GPI) initiative, which aims to improve the customer experience in correspondent banking by increasing the speed, transparency, and predictability of cross-border payments.

In a world where cyber threats have become more prevalent, SWIFT has developed the Customer Security Programme to support customers in the fight against cyber-attacks. The program aims to improve information sharing, provide a set of security controls, and assist with cybersecurity preparation.

Challenges and Controversies:

Like any organization, SWIFT has not been without its challenges and controversies. One of the most significant is the role it plays in sanctions. Because SWIFT is the primary method of moving money internationally, when a country is placed under international sanctions, the removal of its banks from the SWIFT network is often a key component of those sanctions. This was the case with Iran in 2012 when SWIFT disconnected Iranian banks from its network as part of the international sanctions against the country over its nuclear program.

However, this ability to enforce sanctions has also been a source of controversy. Critics argue that by agreeing to remove countries from its network, SWIFT has become a tool of foreign policy, which is at odds with its status as an international cooperative.

In terms of technical challenges, SWIFT faces ongoing threats from cyber criminals. In 2016, SWIFT experienced one of the most high-profile breaches when hackers managed to steal $81 million from the Bangladesh Bank. In response to this and other threats, SWIFT launched the Customer Security Programme to help bolster its and its users’ cyber security defenses.

SWIFT in a Digital Age:

As financial technology continues to evolve, SWIFT has been faced with the challenge of keeping pace. The rise of blockchain technology and cryptocurrencies, for example, could potentially disrupt the way cross-border transactions are conducted. Several fintech companies are developing payment systems that aim to provide faster and cheaper international transfers by utilizing blockchain.

In response, SWIFT has launched a number of initiatives to ensure it remains relevant in the evolving financial landscape. It started a proof of concept project using blockchain technology for real-time reconciliation of accounts in 2017. And as previously mentioned, the SWIFT GPI initiative aims to improve the speed and transparency of cross-border payments.

Future Outlook:

Going forward, SWIFT will need to continue innovating to maintain its position in a rapidly changing financial industry. It will need to find ways to integrate with or adapt to emerging technologies like blockchain and cryptocurrencies. At the same time, it must also focus on maintaining the security and reliability of its network, as these are the key features that have made it a cornerstone of the global financial system.

SWIFT’s Future Vision and Strategies:

In the face of a rapidly transforming financial sector, SWIFT has charted out a clear vision to cement its position as the backbone of global finance. A significant part of this vision involves adopting new-age technologies like distributed ledger technology (DLT), API integration, artificial intelligence (AI), and real-time processing. As part of this strategy, SWIFT aims to enable instant and frictionless transactions that can be initiated and completed within seconds, irrespective of the geographic location of the sender and recipient.

To enable this, SWIFT is actively embracing the concept of API banking. APIs, or Application Programming Interfaces, serve as the backbone for many digital services, acting as a bridge between different software applications, allowing them to communicate with each other. By creating standardized APIs, SWIFT is allowing banks to create seamless integrations, resulting in improved efficiencies and better customer experiences.

On the compliance front, a domain that has been a significant challenge for the financial sector, SWIFT is integrating machine learning and AI into its tools. By doing so, the goal is to provide more accurate and efficient identification of fraudulent activities, detection of sanctions, and AML (Anti Money Laundering) compliance.

Impact on the Global Financial Ecosystem:

SWIFT’s initiatives, developments, and constant evolution have far-reaching implications for the global financial ecosystem. For one, it means quicker, more transparent cross-border payments for businesses and individuals. This could, in turn, boost global trade and make it easier for businesses to operate internationally.

For developing nations, improvements in cross-border payment infrastructure could have a significant impact. It could facilitate financial inclusion, improve access to financial services, and boost economic development.

Finally, the emphasis on improved security and compliance could help to make the global financial system safer and more resilient. As cyber threats become increasingly sophisticated, the sort of security measures that SWIFT is implementing are becoming more important.

Partnerships and Collaborations:

SWIFT’s ability to stay ahead of the curve is also due, in part, to its partnerships and collaborations. By working with other entities in the financial sector, including banks, fintech, and regulatory bodies, SWIFT has been able to remain at the forefront of innovation in the industry.

One of the notable collaborations is with the blockchain consortium R3. In 2019, SWIFT announced a partnership with R3 to integrate R3’s blockchain platform with SWIFT’s GPI technology. This initiative marked a significant step towards SWIFT’s active involvement in leveraging DLT for cross-border payments.

In a similar vein, SWIFT has also launched the “Innotribe” initiative to engage with start-ups and fintechs and foster innovation within the financial industry. This initiative has helped SWIFT stay connected with new developments and trends in the fintech world, thereby aiding its evolution.

SWIFT’s Impact on Policy and Regulation:

Due to its critical role in the global financial infrastructure, SWIFT’s operations and policies can have a substantial impact on financial policy and regulation. For instance, SWIFT’s decision to comply with EU sanctions and disconnect Iranian banks from its network in 2012 had significant political implications and sparked a wide-ranging debate on SWIFT’s role in international politics.

Furthermore, the security standards and protocols developed by SWIFT often serve as benchmarks for the financial industry. Through its Customer Security Programme, SWIFT has introduced a detailed framework for mitigating cyber threats, which has guided many financial institutions in shaping their own cybersecurity policies.

As we look towards the future, it’s clear that SWIFT’s journey is set to be as dynamic and impactful as its past. The rise of digital currencies, the increasing integration of AI and machine learning in finance, the global push towards real-time payments – these are just a few of the trends that will shape the evolution of SWIFT in the years to come.

Whether it’s tackling cybersecurity threats, adapting to new technologies, or navigating complex geopolitical landscapes, the coming years will require SWIFT to continue innovating and adapting. The way in which it meets these challenges will play a large part in determining the shape of the global financial landscape.

As the financial world becomes increasingly digitized and interconnected, the role of SWIFT as a facilitator of secure, reliable, and efficient financial communication is more critical than ever. Through continuous adaptation and innovation, SWIFT is well-positioned to remain at the heart of global finance, shaping the industry for years to come.

Understanding SWIFT Standards:

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) operates a network that enables financial institutions worldwide to send and receive information about financial transactions in a standardized and secure environment. To maintain this uniformity and security, SWIFT has established a set of standards that member institutions must adhere to when communicating via the SWIFT network.

SWIFT Message Types and Formats:

At the core of SWIFT standards are its message types, which are categorized based on the types of services and transactions they pertain to. Each message type is identified by a three-digit number; for example, all messages in the 1xx category are related to customer payments and checks, while messages in the 3xx category relate to treasury markets.

Each message has a specific format that it must adhere to. This format is designed to standardize the information in the message, making it easier for the receiving institution to interpret and process the message. The formats are defined using SWIFT’s own syntax language, which ensures that the information is structured logically and consistently.

ISO 20022:

More recently, SWIFT has been transitioning its messaging standards to ISO 20022, a global and open standard for payments messaging. It creates a common language and model for payments data across the globe.

One of the main advantages of ISO 20022 is its ability to carry more and richer data than SWIFT’s existing standards. It also supports end-to-end transaction information, making it easier for banks to comply with regulatory requirements.

Security Standards:

Security is another area where SWIFT has defined a set of rigorous standards. These standards cover a range of areas including authentication, encryption, integrity and non-repudiation, and confidentiality.

The SWIFT Customer Security Programme (CSP) has established a security baseline that all SWIFT users must meet. This includes guidelines and resources to help institutions secure their local environments, detect and respond to security threats, and continuously enhance their security setups.

Adherence to SWIFT Standards:

Compliance with SWIFT standards is mandatory for all institutions that use the SWIFT network. SWIFT closely monitors the messages sent over its network to ensure compliance and provides training and resources to help institutions meet these standards.

Moreover, SWIFT regularly reviews and updates its standards to reflect changes in the financial industry. These changes are typically introduced in November each year, in an update known as the “Standards Release”.

SWIFT Operations Centres: Ensuring Global Financial Connectivity:

SWIFT’s global operations are facilitated through its Operations Centres (OPCs) which are scattered across the globe. The primary role of these centres is to ensure the reliable, secure, and efficient processing and delivery of financial messages throughout the SWIFT network. Here, we delve into the functionalities of these centres and their strategic importance.

Structure of the SWIFT Operations Centres:

SWIFT maintains several Operations Centres worldwide to ensure uninterrupted service. As of my knowledge cutoff in September 2021, the key centres are located in Virginia (U.S.A), Zoeterwoude (the Netherlands), and Diessenhofen (Switzerland), with two additional backup sites. This multi-site architecture enables SWIFT to maintain high resilience and ensure continuity of services even in the event of disruption.

Each of the primary centres is capable of handling the entirety of SWIFT’s operational load, thereby ensuring redundancy and mitigating risks associated with technical failures, natural disasters, or other potential disruptions.

The functionality of the SWIFT Operations Centres:

The primary role of SWIFT’s OPCs is to ensure the efficient and secure exchange of automated, standardized financial information. They handle millions of financial messages every day, ranging from payment instructions to securities transactions.

Data sent through SWIFT’s network is first encrypted, then sent to one of the OPCs. The centre processes the data and sends it to the recipient bank, where it’s decrypted and acted upon. This round-the-clock operation involves stringent security and operational checks to ensure message integrity and confidentiality.

Moreover, the centres play a vital role in monitoring the network and its services. They are equipped with advanced tools for traffic monitoring, incident handling, and problem management, thereby enabling prompt detection and resolution of issues that may impact the network’s performance.

Security at the SWIFT Operations Centres:

Given the sensitive nature of the data handled by SWIFT, security is paramount at the OPCs. The centres are equipped with advanced physical and cybersecurity measures. These include stringent access control, round-the-clock surveillance, and advanced intrusion detection systems. The centres are also designed to be resilient to external threats, including natural disasters.

On the cybersecurity front, SWIFT has a dedicated team of experts working to protect the integrity and confidentiality of the data. This includes regular security updates, constant monitoring for potential threats, and immediate response to any detected anomalies.

The Strategic Importance of SWIFT Operations Centres:

SWIFT’s Operations Centres are critical to its mission of providing a reliable and secure network for financial institutions worldwide. They allow for the uninterrupted operation of the SWIFT network, which in turn, ensures seamless cross-border transactions.

These centres also play a key role in enabling SWIFT to meet its commitment to operational excellence. Through their robust design and the use of state-of-the-art technology, the OPCs provide the high resilience, security, and performance required to handle the enormous volume and variety of financial messages processed by SWIFT every day.

SWIFT Operations Centres are the nerve centres of the cooperative’s global financial messaging services. Their role in ensuring secure, efficient, and uninterrupted financial communication underscores their strategic importance in the realm of global finance. As the financial world continues to evolve and grow, these centres will continue to play a pivotal role in facilitating international financial transactions.

SWIFTNet Network: The Backbone of International Finance:

The SWIFTNet Network is the proprietary communications network used by the Society for Worldwide Interbank Financial Telecommunication (SWIFT) to transmit standardized financial messages between its member institutions. As a fundamental aspect of the global financial ecosystem, the SWIFTNet Network is designed to provide a secure, reliable, and efficient channel for international financial communication.

Overview and Functionality:

Established in 1973, SWIFT created the SWIFTNet Network to provide a private, secure network for member banks to send and receive transactional messages. Today, it has evolved to become the most widely used international interbank messaging system, supporting over 11,000 financial institutions in more than 200 countries and territories.

SWIFTNet Network does not actually transfer funds but instead sends payment orders which must be settled by correspondent accounts that the institutions have with each other. Each transaction conducted over the SWIFTNet Network is standardized according to SWIFT’s specific message types, facilitating seamless communication between different financial institutions around the globe.

Security and Reliability:

Given the importance of the financial messages transmitted over the SWIFTNet Network, a key priority of the system is ensuring robust security. The SWIFTNet Network employs advanced encryption techniques and rigorous security protocols to protect the data being transmitted. Multiple layers of authentication are implemented to verify the identity of the sender and receiver, thus maintaining the integrity of the communications.

SWIFT also provides continual monitoring and control features to ensure the security of the system, including intrusion detection systems and anti-virus protections. This helps maintain the confidentiality and integrity of the data transmitted over the network and prevents unauthorized access.

Innovation and Evolution:

The world of finance is continually evolving, and the SWIFTNet Network has evolved along with it. One of the key recent initiatives has been the introduction of the SWIFT Global Payments Innovation (GPI), an innovative service aiming to improve the speed, transparency, and traceability of cross-border payments.

SWIFTNet is also keeping pace with technological developments such as blockchain technology. While it does not utilize blockchain technology in its core infrastructure, SWIFT has conducted tests to explore the potential uses of the technology for its financial messaging services. This signifies SWIFT’s proactive approach to embracing new technologies to better serve its global user community.

The SWIFTNet Network is the backbone of SWIFT’s messaging services, providing a secure and reliable platform for international financial communication. As the financial industry continues to evolve, SWIFTNet will continue to play a crucial role in enabling financial institutions worldwide to communicate efficiently and effectively.

The network’s ability to continually adapt to the changing needs of the financial industry, as well as its strong focus on security and reliability, make it a vital component of the global financial infrastructure. It will be fascinating to see how the SWIFTNet Network evolves in the future to embrace new technologies and meet the ever-changing needs of global finance.

SWIFT Products and Interfaces:

The Society for Worldwide Interbank Financial Telecommunication, or SWIFT, is a member-owned cooperative providing the infrastructure for financial institutions around the world to send and receive information about financial transactions in a secure, standardized, and reliable environment. While SWIFT’s secure financial messaging service is its primary offering, the cooperative also provides several products and interfaces to help institutions use this service more efficiently and effectively.

SWIFT’s Key Products:

SWIFTNet Link:

SWIFTNet Link is the software that enables institutions to connect their back-office and payment systems to the SWIFT network. It is compatible with several operating systems and provides access to all SWIFT messaging services.

Alliance Access and Alliance Entry:

Alliance Access and Alliance Entry are SWIFT’s messaging interfaces. They connect to an institution’s back-office systems and allow the institution to send and receive messages over the SWIFT network. Alliance Access is the more sophisticated of the two interfaces, offering greater capacity and more extensive integration capabilities.

Alliance Gateway:

The Alliance Gateway is a software component that acts as the interface between Alliance Access and SWIFTNet Link. It can be used to control and monitor message flows and provides features such as load balancing and failover capabilities.

SWIFT GPI:

The Global Payments Innovation (GPI) service is an initiative from SWIFT to improve the customer experience in correspondent banking. GPI aims to increase the speed, transparency, and traceability of cross-border payments by enabling end-to-end tracking of payment messages across the SWIFT network.

Lite2 for Business Applications (L2BA):

L2BA allows third-party providers to offer cloud-based applications that connect to the SWIFT network. These applications can cover a range of business areas, including cash management, trade finance, and securities.

Sanctions Screening and Sanctions Testing services:

These are part of SWIFT’s financial crime compliance portfolio. The Sanctions Screening service is a hosted solution that screens incoming and outgoing messages against the latest sanctions lists. The Sanctions Testing service helps institutions optimize the performance of their sanctions filters.

Interfaces for SWIFT Products:

SWIFT provides interfaces to enhance interaction with its products and services. The interfaces are designed to cater to institutions with different needs and capabilities. The primary interfaces include:

Alliance Web Platform:

This is a web-based interface for manual message creation, repair, and approval. It is used mainly for low-volume messaging and administrative functions.

Alliance Messaging Hub (AMH):

AMH is a modern, highly flexible interface designed to integrate seamlessly with a broad range of back-office systems. It supports high volumes of messaging and provides features for operational control, message routing, and data transformation.

Alliance Workstation:

The Alliance Workstation is a user-friendly interface for operators to control and monitor SWIFT infrastructure and messaging.

SWIFT’s range of products and interfaces provides robust support to financial institutions globally. From secure connectivity to compliance services and sophisticated messaging interfaces, SWIFT’s offerings play an integral role in ensuring smooth, safe, and efficient operations in the global financial landscape. As financial technology evolves, SWIFT continues to develop and refine its products to meet the changing needs of its members.

SWIFT Services:

There are four key areas that SWIFT services fall under in the financial marketplace: securities, treasury & derivatives, trade services. and payments-and-cash management.

Securities:

- SWIFTNet FIX (obsolete)

- SWIFTNet Data Distribution

- SWIFTNet Funds

- SWIFTNet Accord for Securities

Treasury and derivatives:

- SWIFTNet Accord for Treasury

- SWIFTNet Affirmations

- SWIFTNet CLS Third-Party Service

Cash management:

- SWIFTNet Bulk Payments

- SWIFTNet Cash Reporting

- SWIFTNet Exceptions and Investigations

Trade services:

- SWIFTNet Trade Services Utility

SWIFTREF:

Swift Ref, the global payment reference data utility, is SWIFT’s unique reference data service. Swift Ref sources data direct from data originators, including central banks, code issuers and banks making it easy for issuers and originators to maintain data regularly and thoroughly. SWIFTRef constantly validates and cross-checks data across the different data sets.

SWIFTNet Mail:

SWIFT offers a secure person-to-person messaging service, SWIFTNet Mail, which went live on 16 May 2007. SWIFT clients can configure their existing email infrastructure to pass email messages through the highly secure and reliable SWIFTNet network instead of the open Internet. SWIFTNet Mail is intended for the secure transfer of sensitive business documents, such as invoices, contracts and signatories, and is designed to replace existing telex and courier services, as well as the transmission of security-sensitive data over the open Internet. Seven financial institutions, including HSBC, FirstRand Bank, Clearstream, DnB NOR, Nedbank, and Standard Bank of South Africa, as well as SWIFT piloted the service.

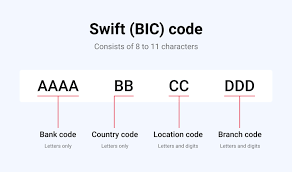

How is a SWIFT/BIC code formatted?

A SWIFT/BIC code consists of 8-11 characters and follows a format that identifies your bank, country, location, and branch.

1 – Bank code (4 letters)

The first four letters represent the bank and usually look like an abbreviated version of the bank name.

2 – Country code (2 letters)

These two letters indicate the country where the bank is located.

3 – Location code (2 letters or numbers)

These two characters designate the location of the bank’s main office.

4 – Branch code (3 digits)

These 3 digits identify a specific branch. ‘XXX’ is used for a bank’s head office.

Frequently Asked Questions about SWIFT: Answers Uncovered

What does SWIFT stand for?

SWIFT stands for the Society for Worldwide Interbank Financial Telecommunication. It’s a member-owned cooperative that provides safe and secure financial messaging services to financial institutions worldwide.

What is a SWIFT code?

A SWIFT code, or Bank Identifier Code (BIC), is a unique alphanumeric code used to identify financial and non-financial institutions. These codes are used when transferring money between banks, particularly for international wire transfers or telegraphic transfers.

Who uses SWIFT?

SWIFT is used by more than 11,000 financial institutions in over 200 countries and territories. Its members include banks, broker-dealers, asset managers, central banks, market infrastructures, multinational corporations, and treasury market participants.

Does SWIFT transfer money?

No, SWIFT does not transfer funds. Instead, it sends payment orders, which must be settled by correspondent accounts that the institutions have with each other. Each financial institution, to exchange banking transactions, must have a banking relationship by either being a bank or affiliating itself with one (or more) so as to enjoy those particular business features.

What information does a SWIFT message contain?

A SWIFT message contains all the details necessary to complete a financial transaction, including the sender’s and receiver’s bank details, the amount to be transferred, currency, and the date and time of the transaction. It may also contain additional instructions related to the transaction.

What is the difference between a SWIFT code and an IBAN?

A SWIFT code identifies a specific bank during an international transaction, whereas an IBAN (International Bank Account Number) identifies an individual account involved in the international transaction. Both play essential roles in the smooth running of the international financial market.

How secure is SWIFT?

SWIFT takes security extremely seriously. It has numerous security measures in place to protect the network and its messaging services from threats, including advanced encryption, authentication, integrity checks, and audit trails. In response to growing cybersecurity threats, SWIFT has also launched the Customer Security Programme to strengthen its users’ security.

What is SWIFT GPI?

SWIFT GPI, or Global Payments Innovation, is a service introduced by SWIFT to enhance the speed, transparency, and traceability of cross-border payments. With GPI, banks can provide their customers with a faster, more efficient, and more transparent international payment service.

How has SWIFT adapted to new technologies like blockchain?

SWIFT has been exploring the potential of blockchain and other new technologies. For example, it has conducted a proof of concept using blockchain technology for real-time reconciliation of accounts. SWIFT also has partnerships with blockchain consortiums like R3, demonstrating its commitment to embracing emerging technologies.

Can SWIFT be used by individuals?

SWIFT itself is a network used by financial institutions to send and receive information about financial transactions. However, individuals indirectly use the SWIFT network every time they send or receive money internationally through their bank, which is a member of the SWIFT network.

How fast are SWIFT transactions?

The speed of a SWIFT transaction can vary depending on a variety of factors, including the two banks involved in the transaction, the country in which they are based, and their respective banking systems. Historically, SWIFT transactions could take a few days, but with the advent of SWIFT GPI, more than half of SWIFT GPI payments are credited to end beneficiaries within 30 minutes.

Is SWIFT used only for money transfers?

No, SWIFT is not used only for money transfers. While one of its primary functions is to facilitate international money transfers, it also provides a range of other services, including securities transactions and treasury communications.

What is SWIFT’s role in international sanctions?

SWIFT can play a significant role in the enforcement of international sanctions. By disconnecting a country’s banks from its network, SWIFT can effectively isolate that country from the international financial system. However, this is a highly politicized and sensitive issue, as was seen when Iranian banks were disconnected from SWIFT as part of international sanctions against Iran.

How does SWIFT deal with cyber threats?

In response to the growing threat of cyber-attacks, SWIFT has implemented a range of security measures, including two-factor authentication, intrusion detection systems, and regular security audits. SWIFT also launched the Customer Security Programme to improve information sharing across the network and to help banks improve their own cyber defenses.

What is the future outlook for SWIFT?

The future of SWIFT is likely to involve continued adaptation and evolution in response to changes in the global financial system and technological advancements. This includes not only developments in payment technologies, but also new challenges such as cyber threats and the need for increased transparency and regulatory compliance. The introduction of services like SWIFT GPI and collaborations with blockchain platforms like R3 indicate SWIFT’s commitment to innovation and progress.

What are the costs associated with using SWIFT?

The costs associated with using the SWIFT network can vary greatly and depend on several factors, including the financial institutions involved, the type of transaction, and any intermediary services required. It’s best to check with your financial institution for specific cost details.

How reliable is SWIFT?

SWIFT is considered highly reliable. Its network operates around the clock and has robust redundancies in place to ensure continuous service. It is used by thousands of financial institutions worldwide, a testament to the confidence that these institutions place in its reliability and security.

Can SWIFT messages be traced?

Yes, SWIFT messages can be traced. Each message sent over the SWIFT network includes a unique identification number, allowing for easy tracking. This feature is particularly useful in case of disputes or misunderstandings and helps maintain transparency in transactions.

Can SWIFT codes change?

Yes, SWIFT codes can change. A bank may alter its SWIFT code due to reasons like a merger, acquisition, or rebranding. When a bank’s SWIFT code changes, the bank will typically inform its customers and advise them on the updated code.

What is a SWIFT MT103?

SWIFT MT103 is a common term in banking that refers to a specific type of SWIFT message. The MT103 is a ‘Single Customer Credit Transfer’ message used by banks to instruct a transfer of funds to a beneficiary. It’s the format that is commonly used for transferring money between banks, particularly for international wire transfers.

What role does SWIFT play in financial compliance?

SWIFT plays a crucial role in financial compliance. Its secure messaging services are used to communicate regulatory reporting information, while its screening solutions help banks comply with anti-money laundering and counter-terrorist financing regulations. Additionally, SWIFT’s KYC (Know Your Customer) Registry provides a standardized approach to managing and sharing KYC data, aiding banks in their compliance efforts.

What is a SWIFT MT202?

The SWIFT MT202 format specifications are used for sending electronic messages concerning money market and banking transactions, specifically bank-to-bank ‘General Financial Institution Transfer’. An MT202 message is sent by or on behalf of the financial institution of the ordering customer, directly or through (a) correspondent(s), to the financial institution of the beneficiary customer.

What is a SWIFT MT940?

The SWIFT MT940 is an end-of-day account statement that provides the details of all debit and credit entries and balance information to the account owner. The statement is issued by banks and sent to their clients to keep them updated on the status of their accounts.

Are SWIFT codes the same as routing numbers?

No, SWIFT codes and routing numbers serve different purposes. A SWIFT code is used for international transactions to identify a specific bank, while a routing number is used to identify a specific financial institution within the United States during domestic transactions.

What is the importance of SWIFT in combating financial crime?

SWIFT plays an integral role in the fight against financial crime by providing services that help financial institutions detect and prevent fraudulent activities. These include tools for transaction monitoring, reporting suspicious activities, and screening for sanctioned entities.

What is SWIFTNet?

SWIFTNet is the infrastructure over which SWIFT’s services and software solutions are delivered. It is a highly secure and reliable system that allows financial institutions worldwide to send and receive information about financial transactions to each other.

Can SWIFT be replaced?

As of now, SWIFT is so deeply integrated into the global banking system and its protocols so widely adopted, it’s unlikely that it could be completely replaced in the near future. However, it’s not invincible to competition. Innovations such as blockchain technology and distributed ledger technology (DLT) could potentially challenge SWIFT’s dominance in the future.

Can two banks have the same SWIFT code?

No, SWIFT codes are unique to each bank. They are designed to precisely identify each financial institution involved in financial transactions worldwide.

How does SWIFT handle data privacy?

SWIFT handles data privacy very seriously. It adheres to strict data privacy regulations and implements high-grade security measures, including advanced encryption techniques, to protect the information transmitted through its network.

How often is SWIFT used?

SWIFT is used extensively. As of my knowledge cutoff in 2021, it was used to send over 33 million financial messages per day. This illustrates the crucial role it plays in global financial transactions.

In 2016 an $81 million theft from the Bangladesh central bank via its account at the New York Federal Reserve Bank was traced to hacker penetration of SWIFT’s Alliance Access software, according to a New York Times report. It was not the first such attempt, the society acknowledged, and the security of the transfer system was undergoing new examination accordingly. Soon after the reports of the theft from the Bangladesh central bank, a second, apparently related, attack was reported to have occurred on a commercial bank in Vietnam.

Both attacks involved malware written to both issue unauthorized SWIFT messages and to conceal that the messages had been sent. After the malware sent the SWIFT messages that stole the funds, it deleted the database record of the transfers then took further steps to prevent confirmation messages from revealing the theft. In the Bangladeshi case, the confirmation messages would have appeared on a paper report; the malware altered the paper reports when they were sent to the printer. In the second case, the bank used a PDF report; the malware altered the PDF viewer to hide the transfers.

In May 2016, Banco del Austro (BDA) in Ecuador sued Wells Fargo after Wells Fargo honoured $12 million in fund transfer requests that had been placed by thieves. In this case, the thieves sent SWIFT messages that resembled recently cancelled transfer requests from BDA, with slightly altered amounts; the reports do not detail how the thieves gained access to send the SWIFT messages. BDA asserts that Wells Fargo should have detected the suspicious SWIFT messages, which were placed outside of normal BDA working hours and were of unusual size. Wells Fargo claims that BDA is responsible for the loss, as the thieves gained access to the legitimate SWIFT credentials of a BDA employee and sent fully authenticated SWIFT messages.

In the first half of 2016, an anonymous Ukrainian bank and others—even “dozens” that are not being made public—were variously reported to have been “compromised” through the SWIFT network and to have lost money.

In March 2022, the Swiss newspaper Neue Zürcher Zeitung reported about the increased security precautions by the State Police of Thurgau at the SWIFT data centre in Diessenhofen. After most of the Russian banks have been excluded from the private payment system, the risk of sabotage was considered higher. Inhabitants of the town described the large complex as a “fortress” or “prison” where frequent security checks of the fenced property are conducted.

See more: